Great Info About How To Claim Paye Tax Back

R193.50 x 3 = r580.50 in total.

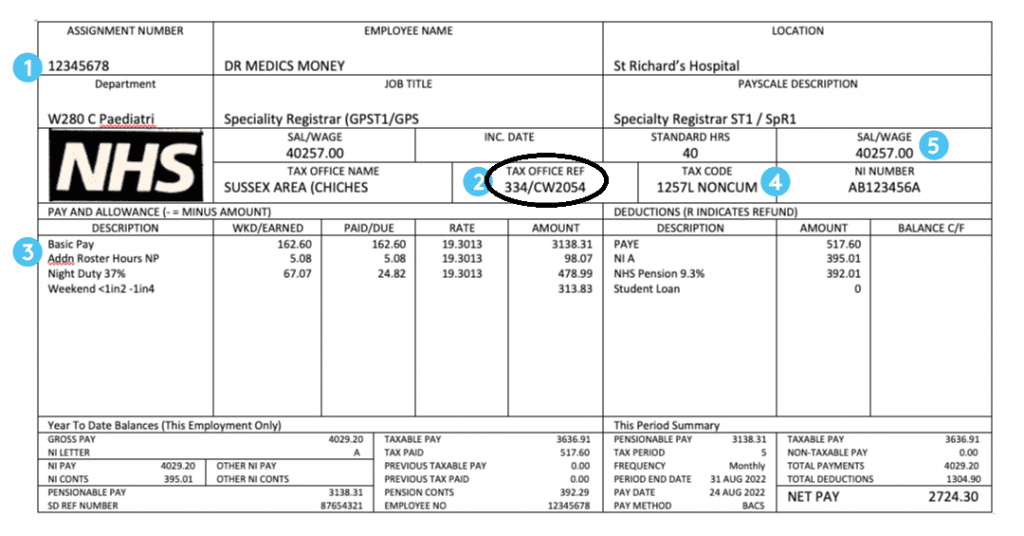

How to claim paye tax back. The easiest way to claim a paye tax refund is by using a tax agent. The quickest and easiest way to complete a paye income tax return is through paye services in myaccount. Www.taxback.co.uk specialises in paye tax refunds.

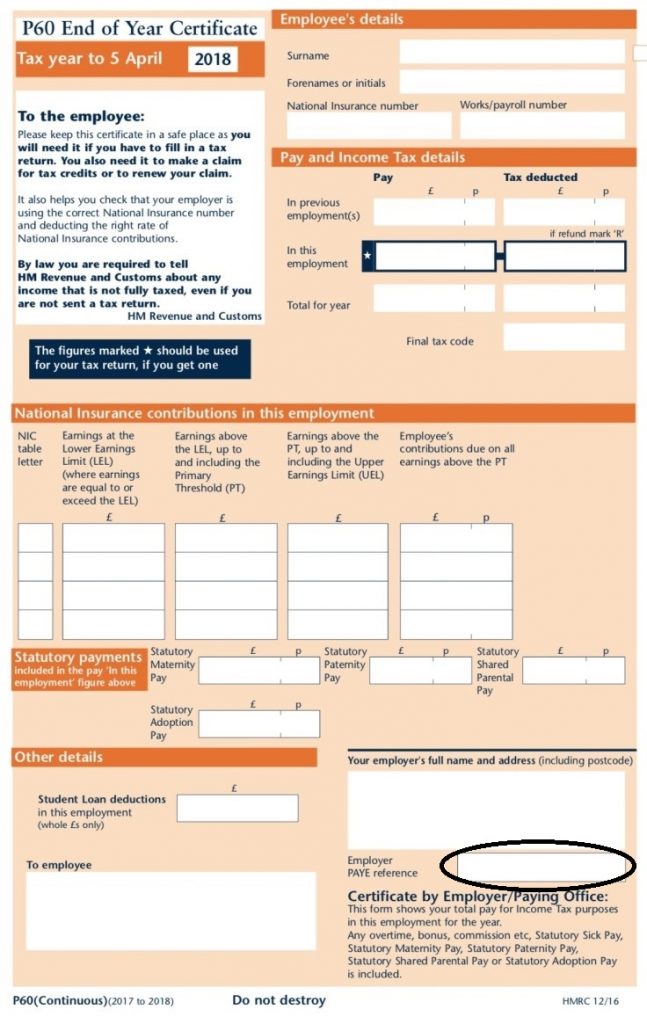

In order to obtain a tax refund or claim, you must complete the hmrc form p85, click on the link online for getting your tax back, fill in the form, print the document. Discover how to claim tax back in ireland with our paye tax refund experts. These reconciliations are based on the monthly employer declarations (emp201) submitted with the tax values of the interim irp5/it3 (a)s certificates.

Get what you're entitled to effortlessly! If you do not usually have. Apply for a paye tax refund.

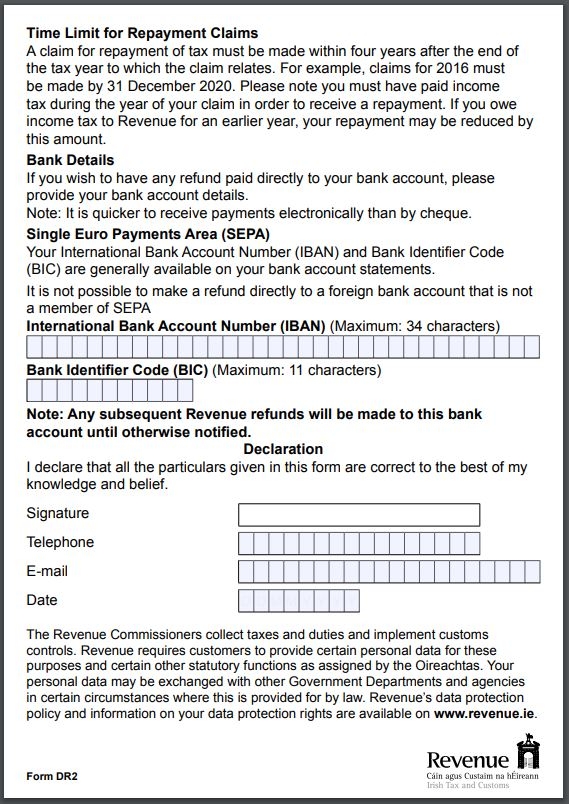

Note that you can claim tax relief going back up to four tax years. If you’ve been working in the uk, you may be entitled to claim a uk tax rebate. If you have paid too much tax, you can get a tax refund.

1 in 3 people who pay tax in the uk are entitled to a tax refund. Online tax software can help you complete your tax return to claim a tax refund for 2021 (you. You have till this spring to claim any 2020 tax money the irs is holding.

You can start your paye tax refund claim online or email the team at [email protected]. Are you looking to apply for a paye tax refund? However for the 2021 tax year tina was under the tax threshold of r83,100 and she should not.

You may be able to get a tax refund (rebate) if you’ve paid too much tax. To claim a refund: You can claim your tax back by either efiling, which is the quickest and easiest way to submit your return.

You can start your paye tax. Www.taxback.co.uk specialise in paye tax refunds. To get tax relief, you have to make a claim to hmrc, but it is not difficult to do so.

Home money personal tax income tax guidance claim personal allowances and tax refunds if you live abroad (r43) how to claim a refund on tax and. You can complete your paye income tax. Log into paye services within myaccount and select ‘claim unemployment repayment’.

Apply for a paye tax refund. Job expenses such as working. You must claim a tax refund within the 4 years after the year in which you made the overpayment.